- An individual has an $8,100000 equilibrium which have a beneficial % notice using one credit card and you will an excellent $seven,100000 harmony with % interest on some other. A beneficial https://www.simplycashadvance.net/loans/payday-loan-consolidation P2P lender is actually willing to provide him $16,100000 for five many years from the mortgage loan regarding a dozen% along with an excellent 5% payment in advance. The new Apr for the loan are %, that’s less than the interest rate to your each other handmade cards. Ergo, he can use this loan to pay off his credit card financial obligation from the a somewhat straight down rate of interest.

- A business manager just who needs the extra money to finance an advertising for their business in the magazine who may have a beneficial large likelihood of introducing many revenue.

- A broke however, higher-potential pupil exactly who needs the excess funds to finance a beneficial temporary go on to a different sort of place in which they are able to potentially get a good esteemed employment and you will quickly become a leading earner to expend off the loan.

Unfortuitously, fraudulent or predatory loan providers would occur. First of all, it is strange for a lender to extend a deal in place of earliest asking for credit score, and you may a lender performing this can be a telltale indication so you can prevent them. Money reported compliment of actual send or because of the cellular telephone have a leading risk of getting predatory. Essentially, these types of loans come with very high rates, extortionate costs, and also brief pay terminology.

Unsecured loans and you may Creditworthiness

The fresh creditworthiness of people is among the chief determining foundation impacting the brand new give regarding a consumer loan. A great otherwise advanced credit scores are very important, particularly when trying to unsecured loans on a great prices. Those with all the way down fico scores will get couples solutions whenever looking to a loan, and you can finance they might safer constantly include bad cost. Instance handmade cards or any other loan signed having a loan provider, defaulting on signature loans could harm someone’s credit score. Lenders that look beyond credit ratings create exist; they use other factors such as financial obligation-to-earnings percentages, secure work background, etc.

Unsecured loan App

The application techniques is usually pretty quick. To make use of, lenders generally speaking ask for some basic advice, plus personal, employment, money, and you can credit report pointers, among a number of whatever else. This post will are from data such as money tax returns, latest shell out stubs, W-dos forms, or your own financial record. Of several loan providers today allow it to be individuals add applications on line. Immediately after submission, info is reviewed and you can affirmed because of the bank. Specific lenders choose instantaneously, while some usually takes a short time otherwise days. Individuals may either end up being recognized, declined, otherwise recognized which have conditions. About your latter, the lending company will provide if the specific conditions was found, such as for example submitting extra spend stubs or data files about assets or bills.

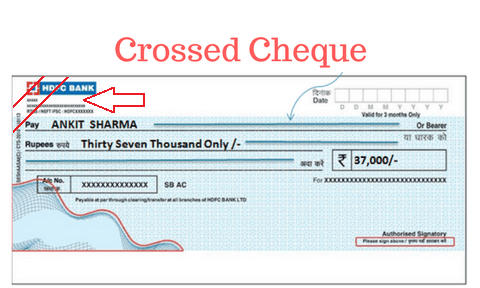

If the acknowledged, signature loans will be financed as fast as within 24 hours, making them somewhat helpful whenever money is needed instantly. They have to come as a lump sum payment for the a bank checking account supplied during the very first app, as numerous lenders need an account to deliver personal bank loan funds via lead deposit. Some lenders can be publish checks otherwise stream money on the prepaid debit cards. Whenever investing the borrowed funds money, make sure to sit contained in this judge boundaries due to the fact denoted regarding bargain.

Consumer loan Fees

In addition to the typical dominant and you will notice costs made toward people form of loan, for personal fund, there are charges when deciding to take notice from.

- Origination fee-Often titled an application percentage, it helps to cover expenses associated with handling programs. It normally range from one% so you can 5% of one’s loan amount. Certain loan providers require the fresh origination percentage upfront although many subtract the cost shortly after recognition. By way of example, $ten,one hundred thousand borrowed that have an excellent 3% origination percentage only internet $9,700 on debtor (the new repayment remains centered on $ten,100000, however).